Why Treasury Management Is Your Company’s Greatest Asset

Your business has several advisors, each of whom plays a different role in its success. Treasury managers may not be the first people you’d think to consult, but without their expertise, you’ll miss out on critical information.

“Treasury management is a critical function because it ensures the organization has sufficient operating capital to meet its daily commitments,” says Tina Stinson, corporate head of treasury management at Northwest Bank. “In addition, it allows a company to better forecast, mitigate risk, manage liquidity, process payments and take advantage of investment opportunities.”

So why do many companies put treasury management at the back of the house rather than view it as an important strategic partner? Many focus on day-to-day transactions and fail to see the role treasury management can play in investing for the future and analyzing the road ahead.

There's a major upside to upgrading your treasury toolbox. By expanding existing tools and services with data analytics and automation, you can transform treasury management into a strategic partner for growth.

How Treasury Management Is Evolving

Traditional treasury management focuses on monitoring cash flow and payments. Today, treasury management takes a broader view, including strategic planning and forecasting for a company’s financial future.

“Treasury management systems not only monitor cash flow, they can help businesses mitigate financial risk by providing them with a centralized platform to manage their cash, investments and debt. This software can also automate tasks such as payments, receivables and bank reconciliations, which can help reduce errors and improve efficiency,” Stinson adds.

Treasury Management’s New Toolkit

Treasury management systems (TMS) are a powerful way to simplify your company’s finances. Imagine saving valuable time spent managing clunky spreadsheets and chasing down invoices with a platform that frees your team to focus on strategic initiatives.

“Companies can improve their cash flow forecasting by capturing and integrating financial data from various sources like sales, inventory and customer payments,” Stinson says. “This data can be used to identify trends and patterns, allowing the business to better predict future cash inflows and outflows.”

Implementing Strategic Treasury Management

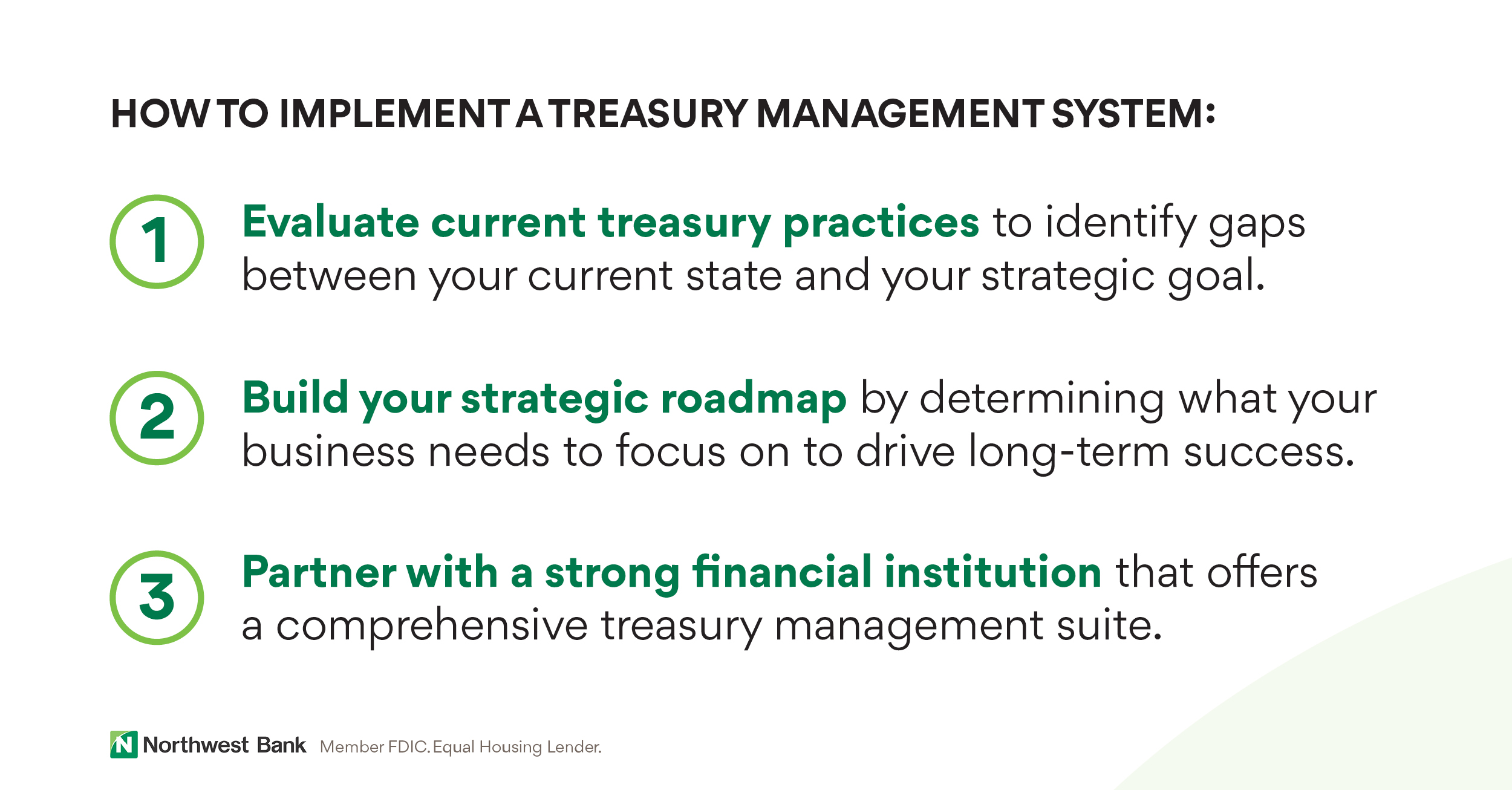

Strategic treasury management goes beyond the basics by focusing on long-term goals — and harnessing powerful tools to do so. It’s important to evaluate your needs and current capabilities before you begin, however.

Assessing the Current State of Your Treasury Management

Take a critical look at your current practices. Is your technology outdated? This could hinder data analysis and integration. How much time is taken by manual processes, such as chasing invoices? Does your team have the expertise needed to use a modern TMS?

An honest evaluation of your technology infrastructure, process efficiency, team expertise and risk management practices can show you the gaps between your current state and your strategic goals. This sets the stage for partnering with a financial institution that offers a comprehensive treasury management suite, one that helps you bridge those gaps and propel your business.

Building Your Strategic Roadmap

Now, define your vision: Does your business need to focus on improving cash flow, mitigating risks, enhancing shareholder value or all of the above? With specific goals in mind, develop a plan to implement new tools and processes.

Successful adoption will require additional training for your team and a well-defined change management strategy — as well as a strong financial partner at your side. A well-defined vision will make it easier to select the right treasury management tools and drive long-term success.

The Future of Treasury Management

Companies today are navigating complex global markets, inflation and uncertain interest rates. They need every asset available from advisory and financial perspectives. Treasury management can be one of those assets — not just a backroom function. An effective TMS is a critical part of any plan to maximize efficiency, mitigate risks and grow the company. The first step is finding the right provider and technology.

“At Northwest, we pride ourselves in providing value-added treasury solutions that improve companies’ cash flow, liquidity and overall treasury operations. We provide clients with insight on industry trends, fraud mitigation tools and the latest payment channels and trends,” Stinson says.

By embracing innovative technologies, businesses can transform their treasury function into a powerful driver of long-term success.