Funds Availability and Overdraft Protection

Understanding Funds Availability

What is a Hold or pending transaction?

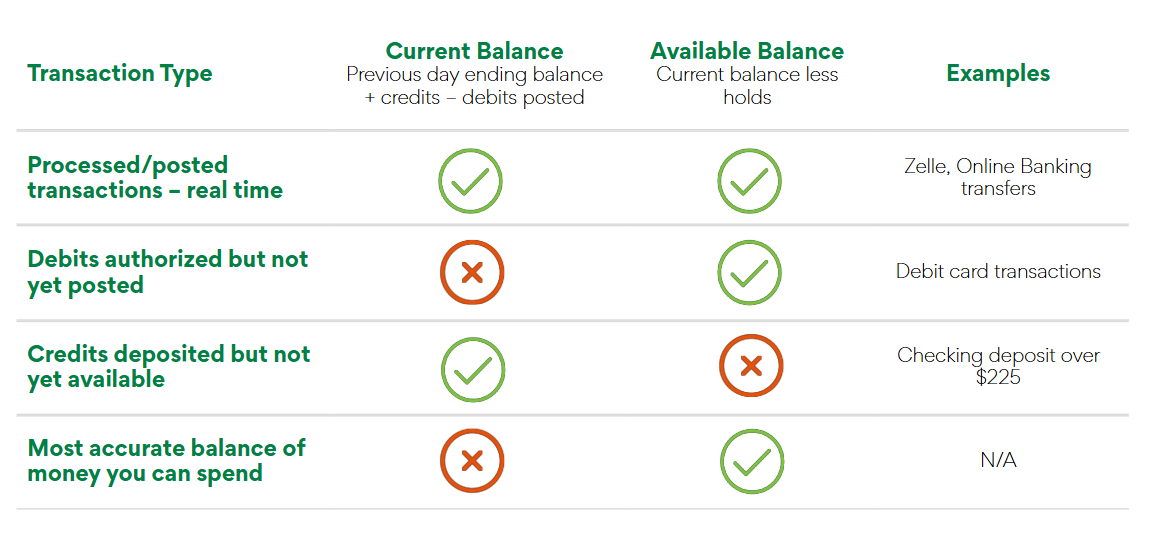

A Hold or pending transaction is a placeholder that reflects all known transactions that have been authorized but not posted to an account. Holds reduce the funds available for withdrawal on an account and are meant to protect customers from overdraft and fraud. Some examples are check deposits over $225 or pending debit card transactions, like security holds on hotel reservations and gas stations tend to place holds on accounts when processing a debit card transaction.

What is a Credit?

A Credit is a transaction that adds money to an account. This could be from direct deposit, teller transaction, ATM, online transfers or mobile deposits, merchant reimbursements and more.

What is a Debit?

A Debit is a transaction that subtracts money from an account. Things like one-time and recurring debit card transactions, ATM withdrawals, check payments, ACH payments or account fees.

What does Posted to my account mean?

Posted means that the Debit or Credit transaction has been processed and reflected in your account’s Current Balance.

What if I don’t have enough money in my available balance?

If you do not have enough money in your available balance, we may decline the transaction or opt to return the transaction, as applicable. If you have opted into everyday debit card coverage, Northwest may authorize and pay certain one-time debit card transactions, even when there are not enough available funds to cover the transaction. However, we do not guarantee the authorization or posting of transactions that will overdraw your account.

Pro Tips:

Ask us about our overdraft protection solutions.

Designed specially to allow customers to use their own funds from another account (Savings, Money Market, Checking, Unsecured LOC* or HELOC*) to bring their account back to a $0 Available Balance when they don’t have enough funds to authorize or pay items.

Understanding Overdraft Protection

Courtesy Overdraft

Our Courtesy options allow Northwest to strive to pay items into overdraft up to a limit assigned to the account when they may not have enough available funds to cover the transaction.

*Line of Credit subject to application and approval, Line of Credit balances are subject to interest charges. See Overdraft Protection Agreement for details.

Courtesy Overdraft Limits are variable and subject to change. Not available for Basic Checking, Student Checking or Health Savings Accounts. Also available for Signature Checking and Priority Checking. Select Ownership Codes are not eligible for Courtesy Overdraft.

Some debit card transactions may be presented as "Must Pay Items" which requires that the bank pay the item. If we are required to pay an item that overdrafts your account, you may be charged an Overdraft Fee.

Consumer Accounts Only