Making a difference.

Dedicated to making a difference in the places where we live and work

We’re proud of our history as a community bank and are dedicated to making a difference in the places where we live and work. From the foothills of Pennsylvania’s Allegheny Mountains, to the vibrant neighborhoods of Columbus, Buffalo and Pittsburgh, to the Indiana heartland, we get involved. We contribute to the mission of organizations throughout our footprint. And our employees lead and volunteer for causes and projects that are meaningful to them, making a positive impact throughout our communities.

How we give back

Our team seeks to engage organizations and partners throughout the Northwest footprint to assess community needs and determine how to best use resources to meet those needs. We are focused on serving low- to moderate-income (LMI) populations and underrepresented groups.

After critical community needs are assessed, innovative and strategic solutions are developed to make a meaningful impact.

We also focus on financial empowerment initiatives with the belief that improved financial knowledge leads to a better future. Drawing upon the expertise of our team members, we have developed and partnered in the creation of financial education programs for the communities we serve.

Community development goals are achieved in three ways:

1. Community Investment

Northwest invests funds to support the creation of jobs, affordable housing, and other services in low- and moderate-income neighborhoods. We feel it is our responsibility to strengthen the communities in which we serve.

Ways we invest:

- Grants that support affordable housing projects and down payment assistance for first-time homebuyers, through both internal and Federal Home Loan Bank of Pittsburgh home loan programs

- Our Northwest Charitable Foundation

- Local donations and sponsorships

- Educational Improvement Tax Credit (EITC) — between 2016 and 2020, Northwest made $2.5 million in qualifying contributions to local schools. A program of the PA Department of Community and Economic Development (DECED) the EITC low- and moderate- income youth with the cost of attending school. Northwest's contributions reflect grants through approved Opportunity Scholarship Organizations (OSO)

- Mortgage-Backed Securities

- Pennsylvania Neighborhood Assistance Program (NAP) — The NAP tax credit program encourages businesses to invest in projects that improve distressed areas or support neighborhood conservation. Projects must fall under one of the following categories: affordable housing programs, community services, crime prevention, education, job training, or neighborhood assistance. The bank invested in projects that provide community services targeted to low- and moderate-income individuals and that revitalize/stabilize a low- or moderate-income area.

- NAP Investment funded between 2018 and 2022 outlined below:

- 2018 - $685,000

- 2019 - $705,000

- 2020 - $790,000

- 2021 - $885,000

- 2022 - $800,000

- NAP Investment funded between 2018 and 2022 outlined below:

2. Community Lending

Northwest is committed to nurturing dreams of prosperity, from homeownership to entrepreneurship. Our motivation stems from doing the right thing and affording everyone, including those who live in low- and moderate-income neighborhoods, the same opportunity to succeed. We are committed to:

- Providing mortgage loans for home purchases, improvement and refinancing located in a low- or moderate- income (LMI) census tract:

- 2018 – originated $55,078 million

- 2019 - originated $66,692 million

- 2020 - originated $94,693 million

- 2021 - originated $100,365 million

- Serving LMI populations and underrepresented borrowers through home mortgage loans:

- 2018 – originated $105,927 million

- 2019 – originated $143,922 million

- 2020 – originated $225,392 million

- 2021 – originated $243,557 million

- Serving the borrowing needs of small businesses and farms with gross annual revenues of $1 million or less

- 2018 – originated $98.8 million

- 2019 – originated $110.6 million

- 2020 – originated $86.8 million

- 2021 – originated $90.1 million

- Financing development in low-to-moderate income areas of communities we serve:

- Provided $3 million funding to an organization that provides community services to low- and moderate-income individuals. The nonprofit organization provides mental health and substance abuse services for children, adolescents and adults from low- and moderate-income households.

- Provided $20.4 million funding to an organization that manages several broadband sectors in rural locations. The organization provides services to rural Pennsylvania counties. Most of their market for high-speed internet covers historically underserved areas with limited and slower DSL, dial-up, or satellite access. Additionally, in most cases, the Company is the only service provider of high-speed internet, allowing it to have a clear bandwidth advantage.

- Funded a $3 million construction loan for a nonprofit community health center that will provide medical and dental services to low- and moderate- income individuals and families. The nonprofit is incorporated to address the growing health needs in underserved communities.

- Provided $2.3 million funding to a charter school with a mission to provide a stimulating and engaging learning environment that recognizes student capability, fosters their immediate and broader communities, and offers them ways to contribute to school life. Over 50% of the students are eligible for free or reduced lunches that attend the charter school and located in a low-income census tract.

- Provided $2.6 million to purchase a senior apartment building with income limitations. Rents are below HUD Fair Market Rents, and the organization operates as a low-income NYS subsidized housing project with capped rates per the Low-Income Housing Tax Credit agreement. The building provides 72 residential units to low-income senior residents.

- Seeking community development opportunities that support affordable housing, economic development, and community revitalization initiatives in low-to-moderate-income neighborhoods from 2018-2021 outlined in the chart below:

|

Community Development Lending |

|

|

|

|

|

|

|

|

|

|

|

Activity State |

Affordable Housing |

|

Community Services |

|

Economic Development |

|

Revitalize / Stabilize |

|

Totals |

|

|

|

# |

$$ |

# |

$$ |

# |

$$ |

# |

$$ |

# |

$$ |

|

Pennsylvania |

72 |

37,790,251 |

106 |

68,467,899 |

6 |

1,757,635 |

9 |

72,770,760 |

193 |

180,786,545 |

|

New York |

43 |

24,511,811 |

32 |

12,993,199 |

1 |

5,000,000 |

1 |

2,205,000 |

77 |

44,710,010 |

|

Ohio |

23 |

11,935,339 |

7 |

17,664,707 |

1 |

5,000 |

0 |

0 |

31 |

29,605,046 |

|

Indiana |

6 |

3,499,348 |

3 |

148,143 |

0 |

0 |

0 |

0 |

9 |

3,647,491 |

|

Regional Activities |

11 |

38,833,000 |

1 |

4,523,500 |

0 |

0 |

0 |

0 |

12 |

43,356,500 |

|

Total |

155 |

$116,569,749 |

149 |

$103,797,448 |

8 |

$6,762,635 |

10 |

$74,975,760 |

322 |

$302,105,592 |

3. Community Outreach & Service

We recognize that being a community bank goes beyond serving the financial needs of families and businesses. Service to our communities takes many forms, including:

- Developing products and services that effectively meet the daily financial management needs of all our clients

- Promoting financial capability by offering training on budgeting, credit, financial management and more

- Forming strategic partnerships with charitable organizations to address community needs

- Supporting community organizations and projects through grants, sponsorships and associate volunteerism. The table below outlines volunteer hours from 2018-2022

Community Development Services - 2018-2022

State of Service

Affordable Housing

Community Services

Economic Development

Revitalization / Stabilization

Total

# Hours

# Hours

# Hours

# Hours

# Hours

Pennsylvania

1,331

12,400

2,717

1,940

18,388

New York

748

6,943

215

567

8,473

Ohio

139

2,439

30

24

2,632

Indiana

263

2,391

172

0

2,826

Regional

0

121

0

36

157

Total

2,481

24,294

3,134

2,567

32,476

- Conducting community listening sessions to learn how we can best provide support

Specialty Programs

At Northwest Bank, we offer flexible lending programs throughout our assessment areas. Northwest’s specialty loan programs empower clients who might not qualify for a traditional mortgage or checking accounts to achieve their dream of homeownership or money management.

Through our specialty home loan programs, consumers can purchase a home with as little as 3% down and enjoy a lower monthly payment with no Private Mortgage Insurance (PMI) requirements. These programs include:

-

First Time Homebuyers Program – The bank introduced its first in-house loan program in November 2012. This program targets low- and moderate-income families and individuals who have not owned a home within the last three years. As part of the program, borrowers must complete a homebuyer course. For borrowers that meet certain income limitations, this program provides flexible credit score and down payment requirements with competitive interest rates and reduced bank fees.

-

Affordable Housing Loan Program – The bank introduced another in-house loan program in April 2013, targeting low- and moderate-income borrowers throughout the assessment areas who meet the qualifying income guidelines. This program offers flexible credit score and down payment parameters with competitive interest rates and reduced bank fees. Loans can be used for either home purchase or refinance purposes.

-

Heroes Loan Program – The bank created this in-house loan program in 2014 for qualifying applicants who are active military service members, reservists, honorably discharged veterans and first responders. This program offers flexible credit score and down payment options with competitive interest rates and reduced bank fees. Loans can be used for either home purchase or refinance purposes.

-

First Front Door Program – The bank offers three-to-one down payment and closing cost assistance of up to $5,000 through this Federal Home Loan Bank (FHLB) of Pittsburgh program, which targets low- and moderate-income families and individuals throughout the assessment areas. Borrowers must not have owned a home within the prior three years and participate in a homebuyer course.

-

Hometown Loan Program - The bank offers this in-house loan program for borrowers who meet either the qualifying first-time homebuyer or low- to moderate-income guidelines. Borrowers must contribute 3%of the total cost of the property and must earn less than 80 percent of area median income. Northwest permits second liens from grants such as the FHLB’s First Front Door Program.

-

HomeOne Loan Program – The bank offers the HomeOne Loan Program in partnership with Freddie Mac. The HomeOne Loan Program is a low-down payment option that serves the needs of qualified first-time homebuyers with no geographic or income restrictions.

-

Home Possible Loan Program – The bank offers the Home Possible Loan Program in partnership with Freddie Mac, and offers down payments as low as three percent for very low- to moderate-income homebuyers. This program also offers flexible down payment sources, term flexibility, refinance options and income flexibility.

-

Habitat Loans – New Originations – The bank approached the Habitat for Humanity in each assessment area to see if we could help with any of the organization’s liquidity needs. Today, Northwest offers to complete the loan documents and close the loans in either the bank’s name or the Habitat’s name, depending on the needs of the organization. The bank provides low- and moderate-income borrowers that meet the Habitat’s requirements with a zero percent interest rate loan with no down payment and no mortgage insurance requirement.

-

Habitat Loans – Purchased Existing – The bank maintains ongoing relationships with several Habitat for Humanity organizations in their assessment areas. The bank purchases existing loans in Habitats’ portfolios to help with liquidity needs of these organizations.

-

Loan Modifications – The bank has a loan modification program for borrowers who are potentially facing foreclosure and do not qualify for traditional refinancing options. The program is to avoid foreclosure and provide affordable loan terms.

- Total originations in specialty loan programs outlined below:

Innovative and Flexible Lending Programs - Mortgage Loans

Type of Program

2018

2019

2020

2021

Totals

#

$$$

#

$$$

#

$$$

#

$$$

#

$$$

First Time Homebuyers Program

31

1,984,482

44

3,672,182

22

2,578,002

0

0

97

8,234,666

Affordable Housing Loan Program

13

1,183,278

24

2,158,460

10

1,103,712

0

0

47

4,445,450

First Front Door Program

31

2,067,561

37

2,518,768

0

0

0

0

68

4,586,329

Heroes Loan Program

129

18,517,498

135

20,713,012

181

34,421,015

304

55,177,074

749

128,828,599

Hometown Loan Program & First Front Door

0

0

5

589,650

96

11,161,910

109

11,212,161

210

22,963,721

HomeOne Loan Program*

0

0

13

2,564,680

23

3,682,309

38

6,675,323

74

12,922,312

Habitat Loans - Zero Equivalent (Originations) & First Front Door

5

441,433

11

956,343

20

2,062,862

2

252,200

38

3,712,838

Habitat - Purchased Loans

44

2,190,612

17

1,415,540

27

1,761,039

0

0

88

5,367,191

Home Possible Loan Program/FFD

0

0

12

1,492,653

142

15,746,338

245

25,898,475

399

43,137,466

Loan Modification

22

1,340,614

30

1,626,819

24

1,556,648

30

2,293,506

106

6,817,587

Total Mortgage Loan Programs

275

27,725,478

328

37,708,107

545

74,073,835

728

101,508,739

1,876

241,016,159

- ‘Second Chance Checking’ – Northwest provides a basic checking account to individuals who do not qualify for a regular account due to past banking issues, such as a closed account resulting from unpaid overdraft fees. This account helps the unbanked rebuild a banking relationship. The account includes quarterly financial education resources and is a safe, affordable transaction account designed for those who might not otherwise have access to one.

Other Products and Programs

Northwest offers several other innovative and flexible loan products and programs. Government loan programs include:

- SBA Loans – The bank remains a certified lender with the Small Business Administration (SBA) and participates in the Loan Guaranty Program (7A). All funds are primarily for start-up business costs of companies whose annual sales are $5.0 million or less and do not exceed $6.0 million in tangible net worth. The bank SBA provides longer terms and amortization periods for small businesses than may be possible with conventional financing. Additionally, the guarantee of the SBA provides more flexible underwriting to qualify more borrowers.

- FSA Loans – The bank offers the USDA’s FSA guaranteed loans, direct loans or land contract guarantees to family-sized farmers and ranchers to start, improve, expand, transition, market and strengthen family farming and ranching opportunities.

- FHA Loans – The bank offers mortgage loans issued and insured by the FHA that allow homebuyers to make a minimal down payment, finance a portion of the closing costs and qualify at higher debt ratios.

- VA Loans – The bank offers mortgage loans guaranteed by the VA that offer long-term financing to eligible American veterans or their surviving spouses. The basic intention of the VA loan program is to supply home financing to eligible veterans in areas where private financing is not generally available and to help veterans purchase properties with no down payment.

- USDA Rural Housing Loans - The USDA’s single-family housing programs provide homeownership opportunities to low- and moderate-income families residing in rural areas through several loan, grant, and loan guarantee programs. The programs also make funding available to individuals to finance vital improvements necessary to make their homes decent, safe and sanitary

- Total originations in these loan programs are outlined below:

Innovative and Flexible Lending Programs

Type of Program

2018

2019

2020

2021

Totals

#

$$$

#

$$$

#

$$$

#

$$$

#

$$$

SBA Loans

58

$ 9,228,300

70

$ 12,495,600

52

$ 9,807,300

68

$ 18,914,900

248

$ 50,446,100

FSA Loans*

5

$ 2,176,325

2

$ 70,000

0

$ -

0

$ -

7

$ 2,246,325

VA Loans*

0

$ -

0

$ -

28

$ 5,320,474

12

$ 2,507,360

40

$ 7,827,834

FHA Loans*

0

$ -

0

$ -

42

$ 6,918,348

62

$ 10,006,019

104

$ 16,924,367

USDA Loans*

0

$ -

0

$ -

66

$ 7,733,365

41

$ 4,905,050

107

$ 12,638,415

Subtotal: Government Loans

63

$ 11,404,625

72

$ 12,565,600

188

$ 29,779,487

183

$ 36,333,329

506

$ 90,083,041

- Disaster Relief Loan Programs :

- Paycheck Protection Program (PPP) – In response to the COVID-19 pandemic, Northwest Bank participated in this SBA program designed to provide a direct incentive for small businesses to keep their workers on the payroll. The SBA forgave loans if the business keeps all employees on the payroll for eight weeks and uses the money for payroll, rent, mortgage interest or utilities. Through PPP, Northwest originated 7,414 totaling $722.5 million.

- COVID-19 Consumer Special Impact Program – In response to the COVID-19 pandemic, the bank created this unsecured loan program that offers loan amounts between $1,000 and $3,000 with terms from 12 to 24 months with an interest rate of 5.99%. In addition, borrowers can delay the first payment date 90 days from loan closing. This program is for existing Northwest mortgage, home equity, consumer, and/or deposit customers only.

In accordance with the Community Reinvestment Act (CRA) Regulation BB, Northwest is required to maintain and make available for public inspection a complete CRA Public File, which includes the results of our most recent FDIC CRA Performance Evaluation.

Northwest uses the parameters and guidelines of the CRA Performance Evaluation to help guide our approach to serving our communities, and we are proud of the results we have achieved and the positive impact we have had on our communities.

We are proud to say that our FDIC 2020 CRA rating was Outstanding for all three performance tests (lending, investment and service)

Access Northwest's CRA Public File.

Charitable Giving – Partnering to strengthen our communities

Throughout our more than 125-year history, Northwest has been focused on strengthening the communities we serve through corporate sponsorships and Foundation grants. This commitment to charitable giving serves as the cornerstone of our identity and helps define our mission as a community bank.

About the Northwest Charitable Foundation

The Northwest Foundation makes contributions to nonprofit organizations to fund large-scope and large-impact programs and/or projects. The Foundation is part of Northwest's overall charitable giving initiative, which enables us to support programs that improve quality of life in areas of Indiana, Ohio, Pennsylvania, and New York where our customers, associates and shareholders live and work.

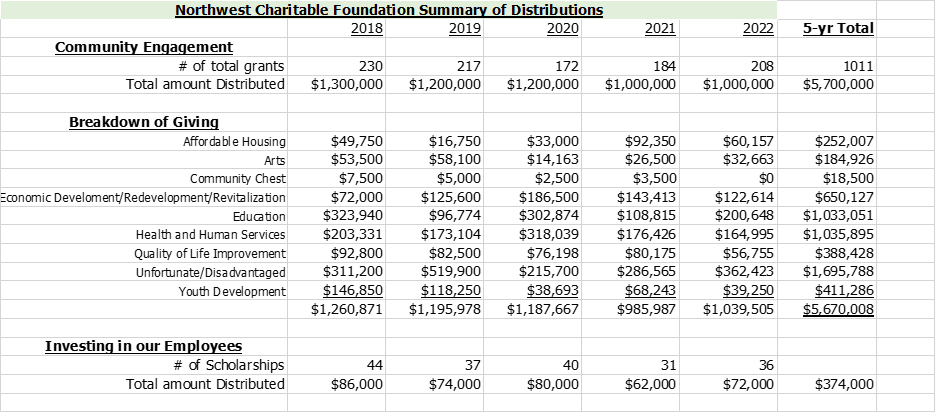

Here’s a breakdown of the Foundation’s overall giving in recent years. Total distributions form 2018 to 2022:

- 2018 - $1,260,871

- 2019 - $1,195,978

- 2020 - $1,187,667

- 2021 - $985,987

- 2022 - $1,039,004

This includes a breakdown as follows:

Partnering through events and sponsorships

At Northwest, we provide monetary support for community events or activities that enable us to partner with a variety of community organizations. Here are some examples:

- One-time or special events (races/walks or benefits)

- Fundraisers

- Golf tournaments and scrambles

- Corporate tables at galas

- Advertisements

- Sporting events

- Foundation grants

- 501(c)(3) tax-exempt organizations

- Opportunities that support our funding priorities

- Initiatives that have widespread community impact with measurable outcomes

- Priority consideration for initiatives that support low- to moderate-income individuals

Financial Education – Providing and supporting financial education is a major focus for Northwest

Improved financial knowledge leads to a better future for individuals and families and, in turn, stronger communities. Drawing upon the expertise of our associates, we have developed or partnered in the creation of several financial education programs for the communities we serve.

Belmont Financial Education Center

Located at 1140 Jefferson Avenue in Buffalo, the center provides financial education and counseling to individuals, families and businesses in the community—no strings attached—empowering them with the knowledge and tools they need to improve their financial health.

The Belmont Financial Education Center will help to close the racial wealth gap that exists in the city of Buffalo. We’ll see people who live on the East Side of Buffalo be able to put their children through college, be able to invest in homes, be able to start businesses and retire in comfort and security. This is what true economic development looks like.

Northwest Bank Awards

Northwest received Honorable Mention in the Economic Inclusion category of the 2019 ABA Foundation Community Commitment Awards. The ABA Foundation Executive Director stated, “The level of commitment to corporate social responsibility demonstrated impressed the review panel”. This was due to the bank’s efforts in opening a branch and providing financial education in a low-income area of the east side of Buffalo, NY.

In 2021, Northwest earned the Home Possible RISE Award from Freddie Mac which helps low-income homebuyers secure mortgages.

Volunteer Service

A focus on financial education

Our team members are the people you see mentoring children, building Habitat homes, teaching financial education classes and more. Northwest partners with EVERFI to offer two financial education programs titled Engage and Achieve.

Engage provides financial education workshops cover topics curated by subject matter experts in personal finance, homeownership, and small business, allowing Northwest to impact learners across community service, affordable housing and economic development domains.

Through Achieve, Northwest is able to provide digital financial education.

Resources & Insights

Through our online financial wellness center, we offer free tools and resources for all life stages:

- Financial foundations – includes short videos to provide the foundational education for your personal finances, including checking outs, car loans, credits cards and more

- Home Ownership – provides all you need to know about home ownership, mortgages and refinancing

- Investing in your future – provides tools and insights to help you reach your goals

- Planning for retirement – includes guidance and advice as you think about retirement–no matter your age